Leave Your Message

As the cryptocurrency landscape continues to evolve, Cloud Mining has emerged as a pivotal component in enabling individuals to participate in the digital asset ecosystem without the substantial upfront investment traditionally associated with hardware purchases. According to a recent report by Allied Market Research, the global cloud mining market is projected to reach $1.4 billion by 2026, growing at a CAGR of 9.8% from 2019. This growth is driven by the increasing adoption of cryptocurrencies and the need for efficient mining solutions that reduce operational complexities and environmental impact.

In this comprehensive guide, we will explore the mechanisms behind Cloud Mining, elucidating how it operates, its various models, and the advantages it offers over conventional mining methods. By understanding these intricacies, investors and enthusiasts can better navigate the complexities of this innovative approach to cryptocurrency mining.

Cloud mining has rapidly gained traction as a viable option for individuals looking to enter the cryptocurrency space without the complexities of setting up physical hardware. At its core, cloud mining leverages remote data centers with shared processing power, allowing users to rent mining capacity and receive payouts without maintaining hardware themselves. According to a report by Research and Markets, the global cloud mining market is anticipated to reach USD 1.2 billion by 2025, reflecting a strong interest in decentralized financial solutions.

When delving into cloud mining, it's essential to understand key terminology such as 'hash rate', which measures the computing power of a cryptocurrency network, and 'mining pool', where multiple users combine their resources to improve the chances of earning rewards. Additionally, 'profitability calculators' help miners project potential returns based on current market conditions and operational costs.

Tip: Always consider the reputation of the cloud mining service you choose, as scams are prevalent in this sector. Look for reviews and transparency in operations. Also, keep an eye on the volatile nature of cryptocurrency prices, as they directly impact your mining profitability.

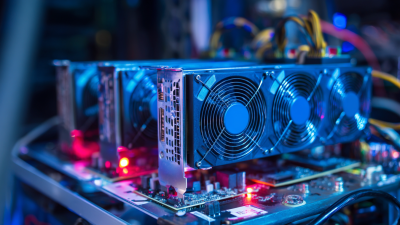

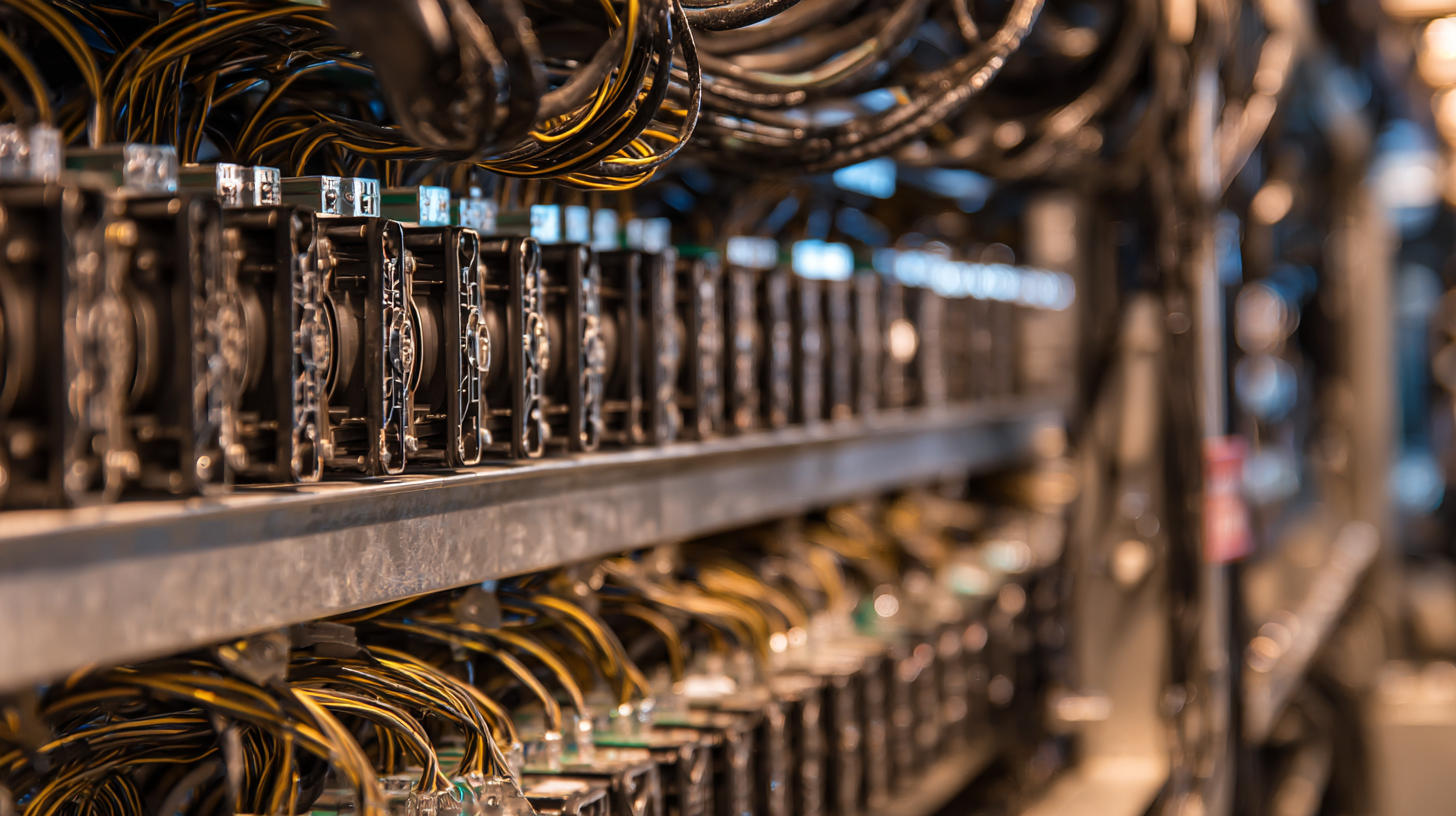

Cloud mining has revolutionized the way individuals can engage with cryptocurrencies by eliminating the need for expensive hardware and electricity costs. At its core, cloud mining allows users to lease computing power from remote data centers, also known as mining farms. These facilities house powerful mining rigs that perform complex calculations to validate transactions on various blockchain networks. When you engage in cloud mining, you’re essentially renting a portion of this computational power, which translates into a share of the profits generated from the mining process.

The technical processes involved in cloud mining begin with the selection of a reliable service provider. Users typically choose a cloud mining platform based on its trustworthiness, the mining algorithms it supports, and the terms of service. Once a user subscribes to a mining contract, they are assigned a certain amount of hashing power. This power is measured in hashes per second and determines the rate at which transactions can be processed. The income generated from mined coins is distributed proportionally based on the amount of hashing power rented, allowing users to earn cryptocurrencies without the technical know-how or infrastructure that traditional mining requires.

When considering cloud mining, it's essential to evaluate providers based on several key factors to ensure a safe and profitable investment. One critical element is the provider's reputation in the industry. According to a report by Statista, the global cloud mining market is expected to grow at a CAGR of 14.5% from 2021 to 2028, indicating that while there are many legitimate services, the increasing demand also attracts scams. Users should always verify company backgrounds through reviews, forums, and trust metrics before engaging.

Another vital consideration is the cost structure of cloud mining contracts. A recent analysis from Blockchain.com revealed that the average profitability of mining contracts can vary significantly, often dependent on electricity costs and hardware efficiency. Prospective miners should closely inspect fee schedules for maintenance and operational costs, ensuring that the potential return justifies the initial investment. Understanding these financial aspects is crucial, as the mining landscape is influenced by market volatility and changes in mining difficulty, which can affect profitability dramatically.

When considering cloud mining, one of the most critical aspects to analyze is the balance between costs and potential revenue. Cloud mining allows individuals to lease mining power from a third-party provider, eliminating the need for physical hardware and associated maintenance. However, while this model can provide flexibility and accessibility, it’s essential to understand the various costs involved. These may include service fees, electricity costs charged by the provider, and the initial investment in purchasing hash power. Each of these factors can significantly impact the overall profitability of cloud mining ventures.

On the revenue side, users must evaluate the cryptocurrency market and its volatility. The returns from cloud mining depend on the cryptocurrencies being mined, as well as overall market conditions. For example, if Bitcoin prices soar, even a small amount of mined Bitcoin can yield significant profits. Conversely, if prices drop, miners may find it challenging to cover their costs. Therefore, a comprehensive analysis of both current market trends and projected growth is vital for anyone looking to enter the cloud mining space. Understanding the interplay between these costs and potential revenue can help investors make informed decisions and optimize their mining strategies for better profitability.

| Dimension | Details | Cost (per month) | Revenue Potential (per month) | Net Profit (per month) |

|---|---|---|---|---|

| Server Type | High-performance GPUs | $1500 | $1800 | $300 |

| Data Center Location | Low Electricity Cost | $1000 | $1300 | $300 |

| Maintenance Fees | Regular Upkeep | $200 | $0 | -$200 |

| Contract Duration | 1 Year | $1200 | $1600 | $400 |

| Total | $3900 | $4000 | $100 |

Cloud mining has emerged as a popular alternative for individuals looking to engage in cryptocurrency mining without the need for expensive hardware. However, it is essential for potential miners to understand the risks and challenges associated with this model. One major concern is the volatility of the cryptocurrency market; for instance, Bitcoin prices can fluctuate dramatically, which impacts profitability. Recent reports highlight that the cost to mine one Bitcoin in various locations, such as Ethiopia, stands at around $1,986, making it one of the cheapest locales but still far from risk-free.

To mitigate risks, miners should conduct thorough research before selecting a cloud mining provider. It's crucial to analyze the platform's track record, user reviews, and the transparency of its operations. Beginners should also be wary of hidden fees that can eat into profits.

Tip: Always compare multiple cloud mining services to find the most reliable and cost-effective options available. Additionally, it can be beneficial to diversify your investments across different cryptocurrencies to minimize potential losses. Given the current pressures on individual miners, understanding these nuances can make a significant difference in your cloud mining experience.