Leave Your Message

As the cryptocurrency market continues to evolve, many investors and enthusiasts are turning their attention to the profitable world of mining. Selecting the best crypto to mine is essential for maximizing returns, especially considering that over 90% of the total Bitcoin supply has already been mined, leading miners to explore alternative coins. According to a recent report by Crypto Mining Insights, the profitability of mining varies significantly across different cryptocurrencies, influenced by factors such as network difficulty, rewards, and market trends. Additionally, as the energy landscape shifts towards renewable sources, miners equipped with sustainable energy solutions are likely to see even greater profitability.

With numerous options in the market, this guide will explore how to effectively choose the best crypto to mine, ensuring that you capitalize on the lucrative opportunities that lie ahead in this dynamic sector.

Cryptocurrency mining has become a popular means for individuals to earn passive income, but for beginners, the process can seem daunting. At its core, mining involves validating transactions on the blockchain and, in return, miners are rewarded with new coins. Understanding the fundamentals of how mining works is crucial for those looking to enter this space. You’ll need to familiarize yourself with concepts such as hash rates, mining pools, and consensus algorithms, as these are integral to the mining process.

When selecting a cryptocurrency to mine, various factors contribute to its profitability. Beginners should take into account the coin's market capitalization, current price, and the level of competition. Additionally, hardware requirements can vary significantly between different cryptocurrencies, so it’s essential to choose a coin that can be mined with your available resources. Performing thorough research on potential coins, their communities, and future growth prospects is key to making an informed decision that maximizes your mining returns.

When selecting a cryptocurrency to mine for maximum profitability, several key factors should be taken into consideration. First, the mining difficulty and hash rate are crucial parameters. A lower mining difficulty typically means that you can mine coins more easily, which can lead to quicker returns on your investment. Additionally, evaluating the current hash rate of the cryptocurrency ensures that you can compete effectively with other miners in the network. High competition can eat into your potential profits, making it essential to find a balance between difficulty and profitability.

Another significant aspect to consider is the current market value and future potential of the cryptocurrency. Analyzing the price trends and market sentiment can help you gauge whether a coin is likely to appreciate in value. Moreover, it is essential to keep an eye on development activity and community support for the cryptocurrency project, as strong development can indicate a promising future. Lastly, don’t forget to analyze the energy costs associated with mining. High electricity expenses can quickly negate your gains, so selecting a coin that aligns with your energy efficiency will ultimately influence your bottom line.

This chart illustrates the profitability of different cryptocurrencies based on current market conditions, mining difficulty, and energy costs. The selected cryptocurrencies are Ethereum, Litecoin, and Monero, showcasing their potential ROI for miners.

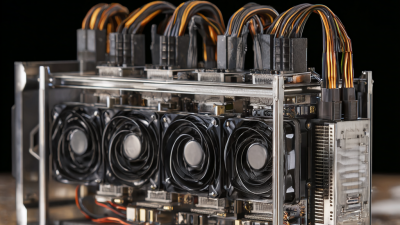

When considering the best cryptocurrency to mine for maximum profitability, evaluating your mining hardware is crucial. The performance of your mining rig plays a significant role in determining your overall returns. Key factors to examine include the hash rate, power consumption, and initial costs associated with the hardware. A higher hash rate indicates a better ability to solve cryptographic problems, which translates to more rewards. However, it's equally important to balance this with the power consumption, as higher energy costs can eat into your profits.

Additionally, ensure that you account for the longevity and reliability of your hardware. Mining equipment can be a significant investment, and selecting reliable models that provide consistent performance is essential for sustained profitability. Researching the latest technology, such as ASIC miners for Bitcoin or GPUs for altcoins, will give you a clearer picture of which hardware will deliver optimal results. Moreover, keeping an eye on hardware availability and pricing trends can help you make an informed decision, allowing you to maximize returns while minimizing risk.

When venturing into cryptocurrency mining, selecting the right coin can significantly influence your profitability. Analyzing profitability requires a deep dive into various tools and calculators that can assist miners in making informed decisions. For instance, understanding metrics like hash rate, electricity costs, and current market prices is essential. Using calculators that factor in these variables allows miners to estimate potential returns and identify which cryptocurrencies yield the highest profits based on their specific equipment and operational costs.

Moreover, as the landscape of cryptocurrency evolves, so does the importance of continuous analysis. Tools that track market trends, historical performance, and future projections are invaluable. For example, with the semiconductor revenue analysis tools projected to grow significantly, advancements in mining hardware are likely to improve efficiency, thus impacting profitability. By leveraging these analytical resources, miners can stay ahead of the curve, maximize their earnings, and ensure their setups remain competitive in the constantly changing crypto market.

When venturing into cryptocurrency mining, avoiding common pitfalls is crucial for maximizing profitability. One of the most significant mistakes is neglecting to assess the mining difficulty of a coin. Many newcomers hastily choose coins that seem appealing based on short-term trends without considering how difficult they are to mine. Higher difficulty means more resources will be required, potentially leading to diminishing returns. Conducting thorough research on the current difficulty and its potential future trends can help miners make informed decisions.

Another frequent error is overlooking the importance of electricity costs. Miners tend to focus on the coin’s price and potential profit without properly calculating the expenses involved in mining. Electricity can consume a large portion of returns, especially if mining hardware is not energy efficient. It’s essential to factor in local electricity rates and the power consumption of mining equipment to ensure that the venture remains profitable in the long run. By being mindful of these common mistakes, miners can position themselves more favorably in this competitive landscape.