Leave Your Message

In recent years, the growing allure of Bitcoin has attracted numerous investors and tech enthusiasts, prompting a surge in the demand for efficient Bitcoin miners. Understanding how to choose the best Bitcoin miner for maximum profitability is crucial for those looking to capitalize on this digital gold rush. According to a report by CoinDesk, Bitcoin mining has become a multi-billion dollar industry, with the global market size expected to reach $1.6 billion by 2025.

As the network's mining difficulty escalates and block rewards decrease due to halving events, selecting the right Bitcoin miner becomes increasingly essential. Data from the Cambridge Centre for Alternative Finance indicates that global Bitcoin mining consumes about 0.5% of the world’s electricity, underscoring the importance of energy-efficient mining solutions. Investors must consider crucial factors such as hash rate, power consumption, and the miner’s lifespan to maximize their returns. By making informed decisions based on comprehensive research and reliable data, potential miners can navigate this complex landscape and enhance their profitability in a competitive environment.

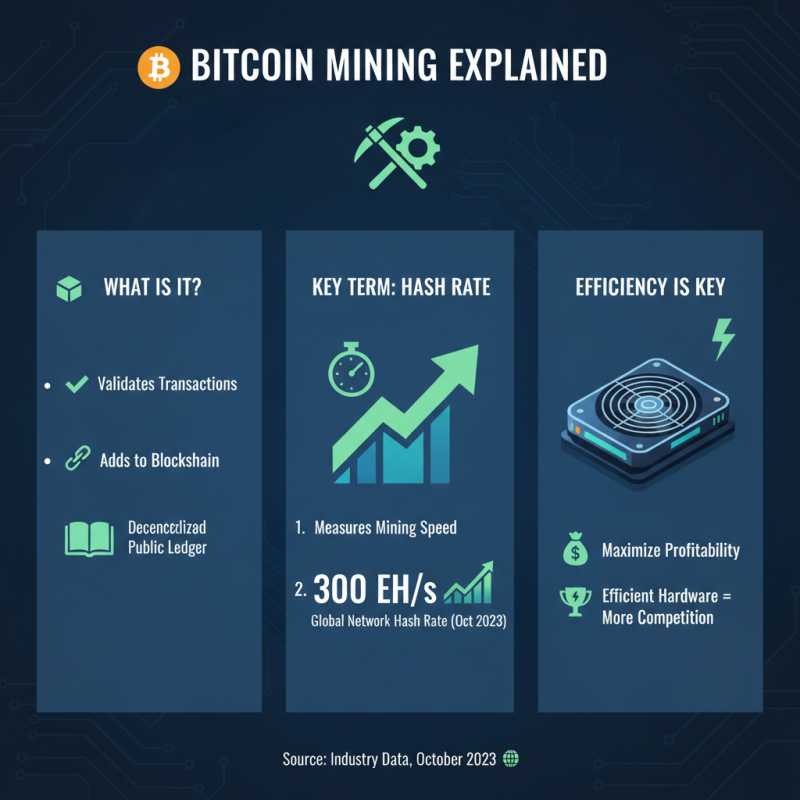

Bitcoin mining is the process of validating transactions on the Bitcoin network and adding them to the blockchain, which is a decentralized public ledger. To understand Bitcoin mining, it’s crucial to grasp some basic terminology. Hash rate, measured in hashes per second (H/s), indicates how quickly a miner can perform the calculations necessary to solve complex cryptographic puzzles. As of October 2023, the global network hash rate has surged to around 300 exahashes per second (EH/s), reflecting the increasing competition among miners. This growth underscores the importance of equipping miners with efficient hardware to maximize profitability.

Another essential term is mining difficulty, which adjusts approximately every two weeks based on the total hash rate of the network to ensure that new blocks are added at a consistent rate of about every 10 minutes. As more miners join the network, the difficulty level increases, making it harder for individual miners to earn rewards. Reports indicate that the mining difficulty has nearly tripled over the past two years, emphasizing the need for miners to stay updated with technological advancements and optimize energy consumption to maintain profitability. Additionally, miners must also consider their operational costs, including electricity consumption, which accounts for a significant portion of mining expenses; current estimates suggest that energy costs can consume up to 60% of a miner's total revenue, making efficient energy use a vital factor for success in the mining landscape.

When selecting a Bitcoin miner, several key factors play a crucial role in ensuring maximum profitability. First and foremost, the miner's hashing power is essential. This parameter determines how quickly the miner can solve complex mathematical problems, which in turn affects its ability to earn Bitcoin. Higher hashing power generally translates to a better chance of mining new blocks and receiving rewards. Therefore, prospective miners should look for devices that offer a strong balance between cost and hashing efficiency.

Energy consumption is another significant consideration. Bitcoin mining requires substantial electrical power, and the associated costs can considerably impact overall profitability. Evaluating the energy efficiency of a miner, measured in watts per gigahash, can help determine the long-term viability of an investment. Miners should seek equipment that optimizes power use without sacrificing performance. Additionally, the availability of cooling solutions is vital, as operational temperature can influence both efficiency and the longevity of mining hardware.

Lastly, potential miners should consider the initial investment and the anticipated return on investment (ROI). Analyzing the upfront costs, including hardware, installation, and ongoing maintenance, against the expected mining rewards will provide clear insights into the financial feasibility of the operation. Careful consideration of market trends and mining difficulty can further aid in making informed decisions about which miner can yield the best results in terms of profitability.

When evaluating mining hardware for Bitcoin, two primary options emerge: ASICs (Application-Specific Integrated Circuits) and GPUs (Graphics Processing Units). Each technology has its own strengths and weaknesses, making the choice intricately tied to both profitability and operational efficiency. ASIC miners are designed specifically for cryptocurrency mining and excel in terms of raw hashing power and energy efficiency. This specialization allows them to deliver higher performance at lower power consumption, making them the top choice for serious miners focusing on scaling their operations.

On the other hand, GPUs are versatile and can be used for a variety of computational tasks beyond mining. While they generally offer lower hashing power compared to ASICs, they have the benefit of being easier to sell or repurpose if mining becomes less profitable. GPUs also tend to generate less heat and noise, making them more suitable for home setups. Additionally, their flexibility allows miners to switch to different cryptocurrencies readily, adapting to market changes. Thus, the selection between ASICs and GPUs ultimately boils down to the miner's individual objectives, resource availability, and risk tolerance within the fluctuating landscape of cryptocurrency mining.

| Mining Hardware | Type | Hash Rate (TH/s) | Power Consumption (W) | Efficiency (J/TH) | Estimated Cost (USD) |

|---|---|---|---|---|---|

| Model A | ASIC | 110 TH/s | 3250 W | 29.5 J/TH | $3500 |

| Model B | ASIC | 85 TH/s | 2400 W | 28.2 J/TH | $2500 |

| Model C | GPU | 50 TH/s | 1500 W | 30 J/TH | $1500 |

| Model D | GPU | 40 TH/s | 1300 W | 32.5 J/TH | $1200 |

When selecting the best Bitcoin miner for maximum profitability, understanding the factors that affect profitability is essential. One key element is calculating the costs associated with mining. These costs typically include electricity expenses, hardware purchases, maintenance fees, and mining pool charges. By creating a comprehensive list of these expenses, miners can set a clear baseline for their financial outlay, enabling better decision-making.

To determine potential returns, miners should estimate their expected Bitcoin yield based on current network difficulty and hash rate. Utilizing profitability calculators can provide insights into daily, weekly, and monthly earnings under varying conditions. A breakeven analysis is crucial; it assesses how long it will take to recoup the initial investment, based on the projected earnings against the ongoing costs.

Tips: Always keep an eye on fluctuating electricity rates as they can significantly impact your profitability margins. Additionally, regularly review the performance of your mining hardware to ensure it remains efficient and cost-effective. Finally, consider joining a mining pool to increase chances of earning Bitcoin, which can help smooth out the income variability associated with solo mining.

When selecting a mining pool, several factors can significantly influence your profitability and overall experience. First and foremost, consider the pool's fee structure. Most pools charge a fee, typically ranging from 1% to 3% of your earnings, which can eat into your profits over time. Assessing how these fees align with your expected earnings is crucial. Additionally, look into the payout scheme offered by the pool; some pools use a PPS (pay-per-share) model, while others may offer a proportional or PPLNS (pay-per-last-N-shares) model. Understanding these payout systems will help you predict when and how much you will receive compensation for your mining efforts.

Another important aspect is the pool's size and reputation. Larger pools often have more consistent payouts due to their higher collective hash power, but they could also lead to lower individual rewards as competition for blocks increases. Alternatively, smaller pools might provide higher payouts per block but with less consistent mining success, resulting in longer wait times for payouts. Make sure to research the pool's reputation in the mining community, as well-established and trusted pools are more likely to maintain their infrastructure and stability. Evaluating these factors will ensure you choose a mining pool that aligns with your goals, maximizes profitability, and enhances your mining experience.